It is vital to surround your self in life with the perfect individuals. A prudent mentor. An encouraging perfect friend. And, yes, even a really terrific tax advisor.

After all, when the worry of tax period starts to smother you into its icy cold adopt, but don't you would like an honest tax pro on your own side? Someone who can help you work through your entire tax concerns and issues? Ofcourse that you are doing!

But finding an tax advisor you can trust is not as straightforward because it used to be. So, exactly what will a trustworthy tax consultant look like? And how can you will find you nearby you?

We are definitely going to accomplish a deep dip around the essential characteristics and things to look for in a tax ace. But first, let's look at why you want one in the very first place.

Why Utilize a Tax Advisor?

Tax returns really are similar to snowflakes--no 2 will be alike! From the number of kids that you have playing around the house to all those odd jobs you chose this past year to pay debt off quicker, you can find dozens of facets that can impact how far you may owe to Uncle Sam and simply how far it is possible to save your taxes from year to year.

Some people have an easy enough situation--they can file their taxes themselves with some on-line tax computer software. But occasionally you are going to be glad you looked to a specialist for aid.

Here are some reasons why you Most Likely Want to consider working with a tax adviser this year:

You moved through a significant life change. Got married? Had an Infant? Congrats! Your tax position is likely to vary, so you'll want to present your tax pro a call once you're back from the honeymoon or completely hauled upon leftovers.

You had countless sources of income or commenced a small business enterprise. That excess money you got in delivering your wedding pictures firm really is fine! But this does mean you may need to handle different tax forms along with issues which you haven't dealt with previously.

You're worried about maybe not getting your taxes done right. There aren't many words in the English language that are scarier when placed with each other than"tax audit." After all, no one would like to get their financial existence picked besides the IRS. Having a tax adviser to guide you personally and allow you to record your own taxes correctly will allow you to breathe a little simpler when Tax dawn has arrived and gone.

Still uncertain whether you must become in contact a tax adviser this particular year? Take our taxation score and also figure out which option is ideal for you--it's going to only take several momemts!

What Should You Look for in a Tax Advisor?

Let's face it: Taxes are as complicated as they are very boring. If you're experiencing difficulty sleeping through the night, pick up a copy of the U.S. tax code and then just begin reading through. That'll knock you out real quick.

But tax advisers --that the fantastic onesaren't like the rest of us. They live, eat and breathe this substance. They are up-to-date on all the hottest developments and changes happening in Tax entire world so that they really will be able to help you recognize that taxation laws, credits and deductions affect one's.

However, looking for a tax pro goes beyond venture expertise. Listed below are just eight significant qualities You Always Need to Search for in a tax adviser before you consent to trust with your taxation:

Inch. They're qualified and have the ideal certificates.

When you are searching for a tax expert, you're going to want to get the job done with somebody that will provide you with quality advice. Put simply , they know what the flip they truly are performing!

When it comes to Obtaining tax information, find an expert who has just one of these two certificates:

Enrolled Agent: An Enrolled Agent is a tax pro for those searching for expert tax return preparation and tax advice. Plus, they've been licensed by the IRS to represent you when you are getting audited.

Certified Public Accountant (CPA): Certified Public Accountants concentrate on tax planning and preparation, however they can also offer a bunch of other agencies to allow you to through the duration of the whole year --from accounting to longterm financial preparation. When your tax problem is really challenging, a CPA can assist with advice on taxation plans to follow in accordance with your circumstances.

Enrolled Agents and also best tax preparer near me CPAs both go through considerable training, schooling and ongoing education to maintain their qualifications and stay uptodate on taxation regulations and laws that they could better last. Somebody with just a preparer tax identification number (PTIN) isn't going to minimize it.

Fun fact: Every single one of the tax Endorsed native Providers (ELPs) is an Enrolled Agent or a CPA. So whenever you work with an ELP, then you can rest sure that you are working with a first-class expert!

2. They can be purchased annually.

Now, there are a lot of part time, flybynight tax preparers showing up during tax year simply to evaporate once they document your tax return, never to be heard from . Maybe not even about a Xmas card.

Like we stated, things transpire through this season that could have a major impact on how you file your taxes for that tax year. When life happens, having a trustworthy tax expert who will select up the phone to reply to your tax questions from September (perhaps not simply January during April) may effect a significant impact.

3. They know your own financial objectives.

Wherever you are about the infant Measures, it helps to have a tax advisor who's on an identical wavelength as youpersonally. That way that they take some time to know about you personally and your monetary targets, so they can give you taxation advice which will drive you closer to reaching those goals.

Whether they are helping you repay personal credit card debt faster during the year by fixing your withholdings or helping you identify potential pros and cons of taking the unwanted hustle to the following stage, then a excellent tax advisor is someone who is always looking for ways to assist you to move the ball farther down the field.

4. They make time to reply to your tax problems.

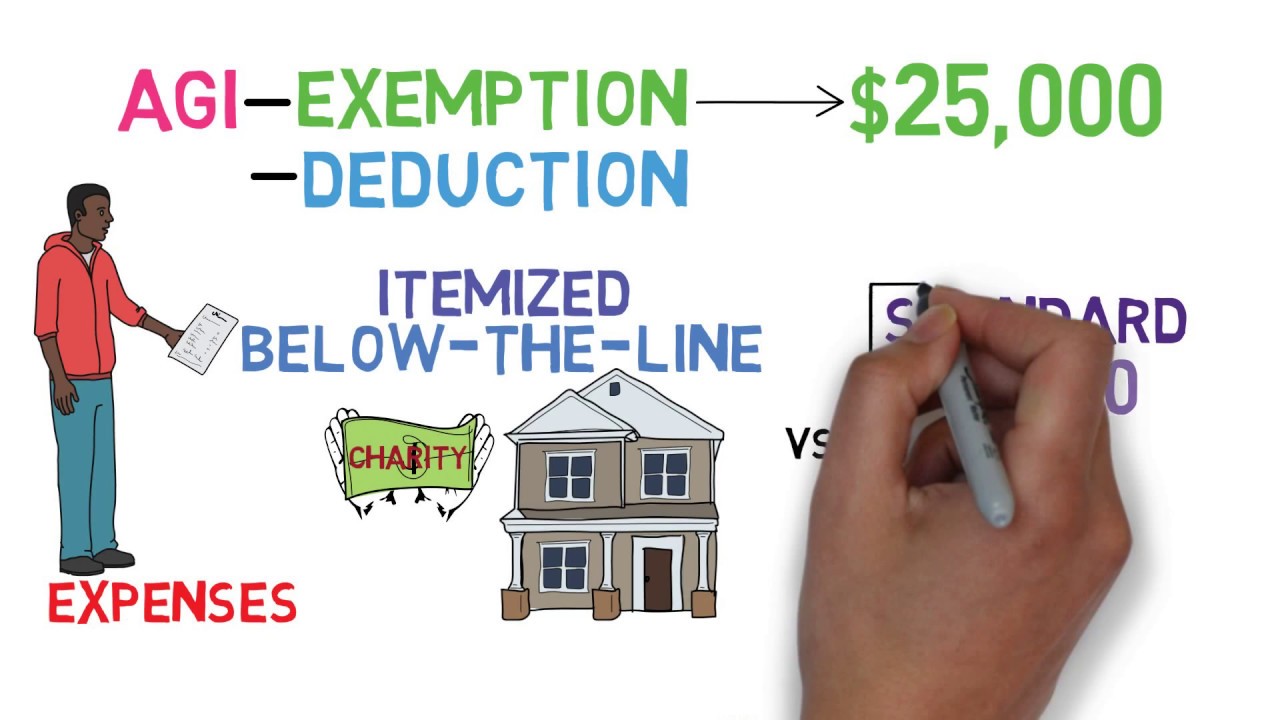

When tax provisions such as"deductions" and"itemizing" and"Adjusted Gross Income" start getting thrown around, your own head probably starts to flood with queries. Do not worry, this is a completely normal response.

Your tax adviser should remain ready to sit with you personally and allow you to answer any and all your inquiries regarding your taxes. That is exactly what this means to have the center of the teacher!

If you're asking questions and your own tax adviser rolls their eyes at you or gives you a high-browed answer that leaves you more confused than you had been previously, it is possibly time to start looking to get a new advisor.

5. They've been proactive in communicating with you.

You really do not merely want someone who places a rubberstamp on your own return and walks away. That's just lazy. You want a tax pro who will select the initiative and also keep an eye out for things which you might want to change for the upcoming calendar year.

Did you get a significant refund? No one wants to provide the government an interest-free loan. Have you seen the way they take care of money? A superior tax expert will choose the opportunity to explain that your company has already been carrying too large an amount of money out of one's pay check for taxation and explain how you can repair it.

Or suppose you have slapped with a big tax bill? Your pro ought to be able to spell out why that has been true and how you can avoid becoming caked next year.

6. They can help you with business taxation.

When you get a small company or whether you're considering starting you , it's easy to forget in everything this signifies when it has to do with your earnings. Nevertheless, you will be happy you have a tax ace with experience working together with small-business owners and will be able to assist you to navigate through business tax prices, approximated taxation and which deductions you meet the requirements for as a small business proprietor.

7. They can assist you along with your taxes following yr... and the year then.

Having a tax adviser you are able to turn to year after year can help save from having to explain the exact points over and repeatedly to a brand new arbitrary taxation preparer each spring. Who has time for it?

In any case, it is helpful to own a tax adviser who understands you as well as your tax case enough to give you powerful ideas and strategies to assist you lower your tax bill.

8. They can be trusted with sensitive info regarding your finances.

Dealing with anybody you like on your taxes might be tempting, however you might not need Uncle Joey to be aware of how much you make, what size your mortgage is and maybe how far you really tithe for your own church? That can make Thanksgiving supper kind of embarrassing!

It is imperative that you locate a tax advisor you can expect with all the bolts and nuts of your financial situation. Trust may be the foundation of almost any strong partnership --including your relationship by means of your tax expert!